Turkey’s Economic Tightrope

Turkey’s Economic Tightrope: Thriving Amid Chaos, But Teetering on

the Edge

Turkey’s economy is

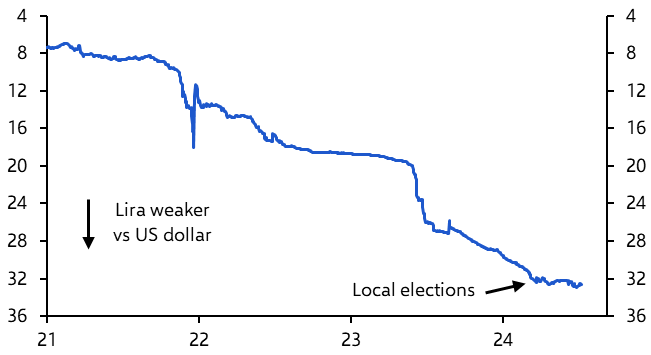

pulling off a high-wire act that would make a circus proud. Despite inflation

hitting 85.5% in 2022, a lira that’s lost 82% of its value against the dollar

in five years, and interest rates at a staggering 50%, Turkey keeps growing—11%

GDP in 2021 (after a lows of 1.9% and 0.8% during the previous two years), 4.5%

in 2023, and 3.2% in 2024. A cheap lira fuels exports, tourism brings in $54

billion, and government handouts keep consumers spending. Unorthodox policies

pre-2023 and a pivot to tighter measures post-election add to the spectacle.

Yet, political meddling, low reserves ($38 billion), and energy import

dependence ($70 billion annually) threaten to topple the act. This blog dives

into Turkey’s resilience, compares it to historical cases, flags derailment

risks, and offers a prognosis. It’s a tale of economic defiance, laced with

irony, where one misstep could send the whole show crashing.

Introduction: The Great Turkish Economic Circus

Picture an economy juggling flaming torches while riding a

unicycle on a tightrope over a pit of alligators. That’s Turkey, defying

gravity with inflation at 37.86% (April 2025), a lira that’s practically

kindling (down 82% vs. the dollar in five years), and interest rates at 50%

that could make a loan shark wince. Yet, Turkey’s GDP grew 11% in 2021, 4.5% in

2023, and 3.2% in 2024, with 3.1% projected for 2025. “It’s like watching a

magician pull a rabbit out of a burning hat,” quips Paul Krugman, Nobel laureate.

As an energy importer spending $70 billion yearly, how does Turkey keep this

act going? And what could send it crashing? Let’s step into the ring, unpack

the irony, and spotlight the risks that could derail this economic spectacle.

Act 1: Defying Economic Logic

Economic theory says high inflation, currency depreciation,

and sky-high rates should tank an economy. “Inflation erodes purchasing power,

depreciation spikes import costs, and high rates choke investment,” says

Raghuram Rajan, former IMF chief economist. Yet, Turkey’s been thumbing its

nose at this logic. The World Bank reports 11% growth in 2021, driven by

post-COVID recovery, with steady gains since. “Turkey’s growth is a puzzle

wrapped in a lira-shaped enigma,” remarks Nouriel Roubini, NYU economist.

Historical parallels exist, but they’re rare. Brazil grew in

the 1980s despite hyperinflation (2,947% in 1990), thanks to commodity exports.

Argentina’s post-2001 default saw 8–9% growth (2003–2007) on a soy boom. South

Korea rebounded post-1997 with export-led growth. “Turkey’s case is unique but

not unprecedented,” says Carmen Reinhart, Harvard economist. “It’s leveraging

exports and demand, but the tightrope is wobbly.”

Act 2: The Tricks Behind Turkey’s Resilience

Turkey’s economic circus relies on clever tricks, each

dripping with irony.

Trick 1: The Lira’s Depreciation Discount

The lira’s 82% plunge makes Turkish goods a global bargain.

Exports—textiles, autos, agriculture—hit $255 billion in 2023, with 40% going

to the EU. Tourism, with 56 million visitors generating $54 billion, is a star

act. “Turkey’s the budget Riviera,” chuckles Daron Acemoğlu, MIT economist. But

energy imports ($70 billion annually, 70% of needs) sting. “The lira’s crash is

a discount for tourists but a tax on oil,” notes Selva Demiralp, Koç University

economist.

Trick 2: Pumping Up Domestic Demand

Government policies—100% minimum wage hikes (17,002 lira in

2024), pension boosts—keep consumers spending despite inflation. “It’s like

giving everyone a raise to buy bread that costs twice as much,” says Joseph

Stiglitz, Nobel laureate. Pre-2023 negative real rates fueled credit binges,

propping up construction. “Consumption is Turkey’s economic caffeine,” says

Uğur Gürses, independent economist. Irony? This fuels the inflation it aims to

offset.

Trick 3: Unorthodox Policy Shenanigans

Erdoğan’s pre-2023 low-rate obsession—contrary to economics

101—kept borrowing cheap. “It’s like treating a fever with ice cream,” quips

Mohamed El-Erian, Allianz chief economist. Exchange rate-protected deposits

($90 billion by 2025) curbed dollarization. Post-2023, CBRT’s Hafize Gaye Erkan

raised rates to 50%, cutting inflation from 75% (May 2024) to 37.86%.

“Orthodoxy is working, but Erdoğan’s shadow looms,” warns Şebnem Kalemli-Özcan,

University of Maryland economist.

Trick 4: A Diversified Economic Tent

Turkey’s economy spans manufacturing (22% of GDP), services

(60%), and agriculture (6%). “This diversity cushions shocks,” says Refet

Gürkaynak, Bilkent University economist. A young population (median age 32)

keeps labor markets dynamic, with unemployment at 8.2% (February 2025).

“Turkey’s youth is its secret weapon,” says Dani Rodrik, Harvard economist.

Tourism and exports offset energy costs, unlike Venezuela’s oil-dependent

collapse.

Trick 5: Geopolitical Juggling

Turkey’s location between Europe and the Middle East is a

goldmine. “It’s a trade hub, even amid chaos,” says Behlül Özkan, Özyeğin

University political scientist. NATO membership and EU trade (40% of exports)

attract FDI, despite governance woes. “Turkey’s leverage keeps investors

knocking, even if they’re nervous,” says Sinan Ülgen, Carnegie Europe analyst.

The catch? Political crackdowns, like the 2025 İmamoğlu detention, spike

volatility.

Trick 6: Banking Sector’s Safety Net

Banks boast capital adequacy above 18% and non-performing

loans at 1.9% (2025). CBRT interventions ($27 billion in early 2025) stabilized

the lira. “The banking sector is a rare bright spot,” says Hakan Kara, former

CBRT chief economist. “But reserves are a house of cards,” warns Atilla

Yeşilada, GlobalSource Partners economist.

Act 3: The Energy Import Paradox

Turkey’s $70 billion energy import bill is a clown car of

costs. “Energy dependence is Turkey’s Achilles’ heel,” says Fatih Özatay, TOBB

University economist. The lira’s fall inflates these costs, yet exports and

tourism dollars mitigate the hit. Renewables (42% of electricity in 2024) and

the Akkuyu nuclear plant aim to cut reliance. “Turkey’s energy strategy is a

slow burn toward resilience,” says Mehmet Şimşek, Finance Minister. Irony? A

weak lira boosts exports but makes every barrel a budget buster.

Act 4: What Could Derail the Show?

Turkey’s act is dazzling but fragile. Here are the five

horsemen that could bring it down:

1. Political Interference

Erdoğan’s meddling—firing CBRT governors, pushing low

rates—could unravel orthodoxy. The İmamoğlu detention triggered a 4% lira drop

and 13% stock market plunge. “Politics is Turkey’s kryptonite,” says Timothy

Ash, BlueBay Asset Management strategist. Impact: Renewed inflation

(50–60%), capital flight, growth below 2%. Likelihood: High, given

Erdoğan’s history and 2028 elections.

2. Low Reserves

Net reserves ($38 billion, March 2025) are thin against

$510 billion external debt. “Turkey’s reserves are a paper towel in a

hurricane,” quips Brad Setser, Council on Foreign Relations economist. Impact:

A balance-of-payments crisis could spike inflation, crash the lira, and trigger

recession. Likelihood: Moderate to high, especially with global shocks.

3. External Shocks

Energy price spikes (Brent at $80/barrel, 2024) or global

tightening could strain Turkey. “Global headwinds could topple the tent,” says

Emre Alkin, Altınbaş University economist. Impact: A $20/barrel oil hike

adds $14 billion to costs, widening deficits and slowing growth. Likelihood:

Moderate, with Middle East tensions a wildcard.

4. Social Unrest and Brain Drain

Inflation has pushed 30% of households below poverty,

fueling brain drain (6,000 professionals left in 2023). “Economic pain breeds

discontent,” says Esra Çeviker Gürakar, TOBB University political scientist. Impact:

Unrest could spur populist policies; brain drain cuts productivity. Likelihood:

Moderate, with protests muted but emigration rising.

5. Governance Erosion

Authoritarian moves and judicial interference deter FDI

($10.6 billion in 2023, down from $13 billion in 2015). “Turkey’s judicial

roulette scares investors,” says Erik Meyersson, SITE economist. Impact:

Reduced capital inflows could trigger a currency crisis. Likelihood:

High, with no governance reform in sight.

Act 5: Prognosis and Red Flags

Short-Term (2025–2026): Growth at 3.1–3.5%, driven by

exports and tourism, with inflation falling to the upper 20s. “Orthodoxy is

taming the beast,” says Murat Üçer, Koç University economist. Long-Term

(2027–2029): Single-digit inflation by 2029 is possible with reforms, but

political risks loom. “Turkey needs a rules-based system,” says Kenneth Rogoff,

Harvard economist.

Red Flags to Watch:

- CBRT

Independence: Governor changes or rate-cut pressure signal trouble.

- Reserves:

A drop below $30 billion risks a crisis.

- Energy

Prices: Brent above $100/barrel strains finances.

- Political

Crackdowns: More opposition arrests could spark sell-offs.

- Social

Metrics: Rising emigration (>10,000 skilled workers yearly) or

protests signal unrest.

Conclusion: A Fragile Spectacle

Turkey’s economic tightrope act—growing amid 85.5%

inflation, a collapsing lira, and energy imports—is a marvel. Exports, tourism,

and policy gymnastics keep it aloft, but political meddling, low reserves,

external shocks, social unrest, and governance woes could derail it. “Turkey’s

juggling is impressive, but one dropped torch could burn it down,” warns

Krugman. Sustaining orthodoxy, boosting reserves, and reforming governance are

critical to avoid a crash. Without these, growth could stall below 2%, with

inflation resurging. Turkey’s circus is dazzling, but the audience should keep

an eye on the exits.

References

- World

Bank. (2024). Turkey Economic Monitor.

- IMF.

(2024). Turkey: Article IV Consultation.

- Central

Bank of the Republic of Turkey. (2025). Monetary Policy Reports.

- Turkish

Statistical Institute. (2025). Economic Indicators.

- Reuters.

(2025). “Turkey’s Lira Falls After İmamoğlu Detention.”

- Bloomberg.

(2024). “Turkey’s Economic Turnaround.”

- Statista.

(2025). Turkey Inflation Projections.

- ENAG.

(2022). Independent Inflation Estimates.

- OECD.

(2024). Turkey Economic Outlook.

- World

Bank. (2024). Country Partnership Framework for Turkey (2024–2028).

Comments

Post a Comment